Technical analysis offers many tools to help traders interpret market behaviour. Among these tools, the MACD stands out for its clarity and versatility. Short for Moving Average Convergence Divergence, the MACD is a momentum indicator that helps traders identify potential shifts in price direction and strength.

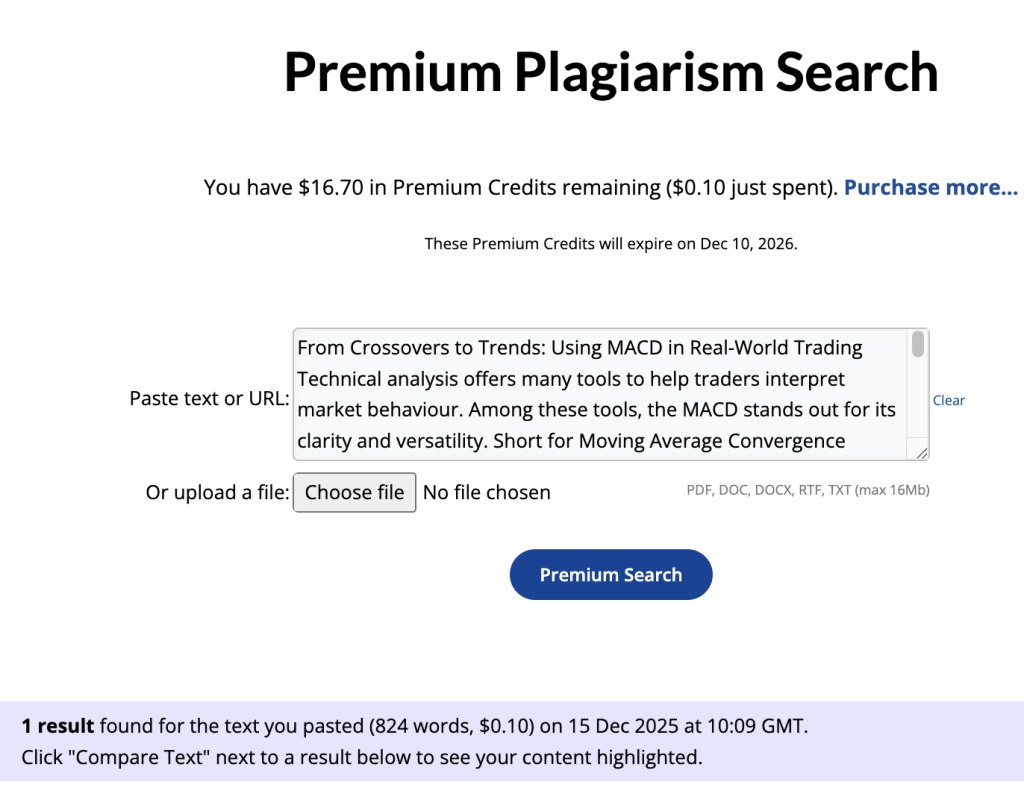

In real-world trading, understanding how to apply MACD signals can enhance decision-making and provide a structured way to interpret price action. This article explores the practical aspects of using MACD, highlighting how it works, common strategies, and how to integrate it into your trading process with confidence.

What Is MACD and Why Does It Matter

The MACD indicator is rooted in moving averages and shows the relationship between two different exponential moving averages (EMAs). Specifically, it subtracts a longer-term EMA from a shorter-term EMA to create the MACD line. A signal line, calculated as an EMA of the MACD line itself, helps smooth out volatility and offers timing cues for potential entries or exits.

What makes MACD particularly useful in real-world trading is its ability to reflect both trend and momentum. Many traders appreciate this dual role because it allows them to see not just where the market might be headed, but also how strong the move could be. Unlike some indicators that focus on trend direction alone, the MACD can alert traders to weakening momentum before price action visibly changes course.

If you are new to this topic and want to explore the fundamentals of this indicator, including how the lines are calculated and visualised, the concept of ACD trading offers a helpful foundation. This resource explains the MACD indicator in a clear, accessible way that reinforces the practical points we will build on in this piece.

Understanding MACD Components

The MACD line highlights the difference between the fast EMA and the slow EMA. When the fast EMA pulls above the slow EMA, it suggests that recent prices are gaining relative strength. Conversely, when the fast EMA falls below the slow EMA, it can signal weakening momentum.

The signal line reflects a smoothed version of the MACD line. Crossovers between the MACD line and signal line are one of the most common ways traders interpret potential shifts in direction. When the MACD line crosses above the signal line, it may indicate an emerging bullish trend. When it crosses below, it could signal a bearish shift.

In addition to these lines, many traders watch the MACD histogram, which displays the difference between the MACD line and the signal line. The histogram’s bars expanding away from zero can suggest strengthening momentum, while shrinking bars can signal waning momentum.

How MACD Crossovers Work in Practice

Crossovers between the MACD line and signal line are among the most widely used signals from this indicator.

In a bullish scenario, the MACD line rising above the signal line suggests a strengthening uptrend. This can be interpreted as a potential time to consider buying opportunities, particularly when the crossover happens below the zero line. A crossover above the zero line may provide added confirmation of an existing uptrend.

In a bearish scenario, the MACD line falling below the signal line suggests growing selling pressure. Long traders may decide to reduce exposure, while more experienced traders might consider short positions when other criteria are met.

Divergence: A Powerful Confirmation Tool

Beyond simple crossovers, divergence between price action and the MACD can offer deeper insight into market dynamics. Divergence occurs when price makes a new high or low, but the MACD does not confirm the move.

Bullish divergence happens when the price makes a lower low, but the MACD forms a higher low. This suggests that downward momentum might be weakening and could precede a reversal. Bearish divergence, on the other hand, occurs when price makes a higher high while the MACD makes a lower high. This indicates that upward momentum may be fading and could foreshadow a downturn.

It is worth noting that divergence does not always lead to an immediate reversal. In some cases, price may continue in the prevailing direction before turning. However, divergence can be a valuable confirmation signal when used alongside other technical factors such as support and resistance levels.

Conclusion

The MACD indicator provides a structured way to interpret momentum and trend behaviour in financial markets. From crossovers to divergence, its signals can help traders identify possible turning points and assess the strength of price moves. In real-world trading, combining MACD with trend analysis, price action, and sound risk management can enhance the quality of your decisions.

Using MACD effectively is not about following rules mechanically. It is about developing an informed perspective of the market, understanding what the indicator is telling you, and integrating that insight into a disciplined trading process. With practice and patience, MACD can be a valuable part of your analytical toolkit, helping you navigate markets with clarity and purpose.